michigan property tax rates 2020

Search Valuable Data On A Property. The special exemption for the 2021 tax year is 2800.

For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is 425.

. 1410 Plainfield Ave NE. Ingham County has the highest average millage rate and. The summer tax bill runs from July 1st of this year to June 30th of next year.

The tax rate for the 2021 tax year is 425. The Certificate of Stillbirth from Michigan Department of Health and Human Services MDHHS for the 2021 tax year is 4900. Before the official 2022 Michigan income tax rates are released provisional 2022 tax rates are based on Michigan.

The qualified disabled veterans exemption for the 2021 tax year is 400. Millage rates are those levied and billed in 2020. The State Education Tax Act SET requires that property be assessed at 6 mills as part of summer property tax.

After the second month to a maximum of 25. Each mill equates to 1 of tax per 1000 of taxable value. Individual Exemptions and Deferments.

The personal exemption for the 2021 tax year is 4900. Heres a list of the 25 Michigan cities and townships with the highest property tax rate for homeowners. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the.

Our Michigan property tax bills cover. Penalty is 5 of the tax due and using TTY through the Michigan Relay Center by calling increases by an additional 5 per month or fraction thereof 711. Follow this link for information regarding the collection of SET.

28 2020 121 pm. This booklet contains information for your 2022 Michigan property taxes and 2021 individual income taxes homestead property tax credits farmland and open space tax relief and the home heating credit program. The 2020 average property tax bill in Michigan was about 2150 on an owner-occupied home according to data from the Michigan Department of Treasury.

In fact there are two different numbers that reflect your homes value on your Michigan real property tax bill. To find detailed property tax statistics for any county in Michigan click the countys name in the data table above. They run a full year.

The Michigan State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated. Below are a few fast facts about trends in Michigan property tax rates. Michigan has some of the highest property tax rates in the country.

Such As Deeds Liens Property Tax More. Estimator allows individual and business taxpayers to estimate their current property taxes as well as compare their property taxes and millage rates with other local units throughout Michigan. The Michigan Treasury Property Tax Estimator page will experience possible downtime on Thursday from 3PM to 4PM due to scheduled maintenance.

2019 total property tax rates in michigan total millage industrial personal ipp lee twp 031120 allegan public school 314749 494749 254749 374749 354749 534749 fennville public scho 278284. The State of Michigan published 2020 rates in Spring 2021 Contact us at. Rates include special assessments levied on a millage basis and levied in all of a township city or village.

The median property tax in Michigan is 214500 per year for a home worth the median value of 13220000. Tax rates and thresholds are typically reviewed and published annually in the. Counties in Michigan collect an average of 162 of a propertys assesed fair market value as property tax per year.

2020 Millage Rates - A Complete List. Michigan Extends 2020 Property Tax Appeal Deadline. Michigan State Tax Tables each year as part of its duty to efficiently and effectively administer the revenue laws in Michigan.

The Michigan State Tax Commission has calculated that the inflation rate multiplier for 2020 will be 19The STC published Bulletin 15 of 2019 which describes the methodology behind the calculation as well as showing all previous inflation rate multipliers since 1995. Start Your Homeowner Search Today. Michigan is ranked number eighteen out of the fifty states in order of the average amount of property taxes collected.

2017 Millage Rates - A Complete List. The Great Lake States average effective property tax rate is 145 well above the national average of 107. When claiming the Michigan property tax credit you need to file form 1040CR along with your income taxes.

2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP COUNTY. The IRS will start accepting eFiled tax returns in January 2020. Rates for 2021 will be posted in August 2022.

2019 TOTAL PROPERTY TAX RATES IN MICHIGAN Total Millage Industrial Personal IPP Lee Twp 031120. The winter tax bill runs from December 1st of this year to November 30th of next year. In total Michigan county and local governments levied 146 billion in property taxes in 2018 at an average rate of 4198 mills.

When comparing Michigan real property tax rates its helpful to review effective tax rates which is the annual amount paid as a percentage of the home value. 2019 Millage Rates - A Complete List. Ad Get In-Depth Property Tax Data In Minutes.

2018 Millage Rates - A Complete List. Total Millage for Principal Residence. Interest is charged daily using the average prime rate plus 1 percent.

Michigans effective real property tax rate is 164. For a nationwide comparison of each states highest and lowest taxed counties see median property tax by state. Michigans effective real property tax rate is 164.

That compares to 141 billion levied in 2008 at an average rate. The average millage rate in Michigan was 42. Rates include the 1 property tax administration fee.

But rates vary from county to county. Rates for 2020 will be posted in august 2021. Michigan is taxed at a flat tax rate of 425 for all levels of income.

Alcona Alcona Twp 011010 ALCONA COMMUNITY SCH 193869 373869 133869 253869 193869 373869 Caledonia Twp 011020 ALCONA COMMUNITY SCH 188531 368531 128531 248531 188531 368531 Curtis Twp 011030 OSCODA AREA SCHOOLS 200781. Under Proposal A of 1994 the taxable value of a property unless there was a transfer or. To add more confusion to the process is every city does their wintersummer taxes differently.

Form MI-1040 - Individual Income Tax Return. On average residents of the Great Lakes State pay 145 of their home. Refer to wwwmichigangovtaxes for current interest rate.

Best Places To Retire To Make Your Retirement Income Go Farther Seeking Alpha Income Tax Retirement Income Income Tax Return

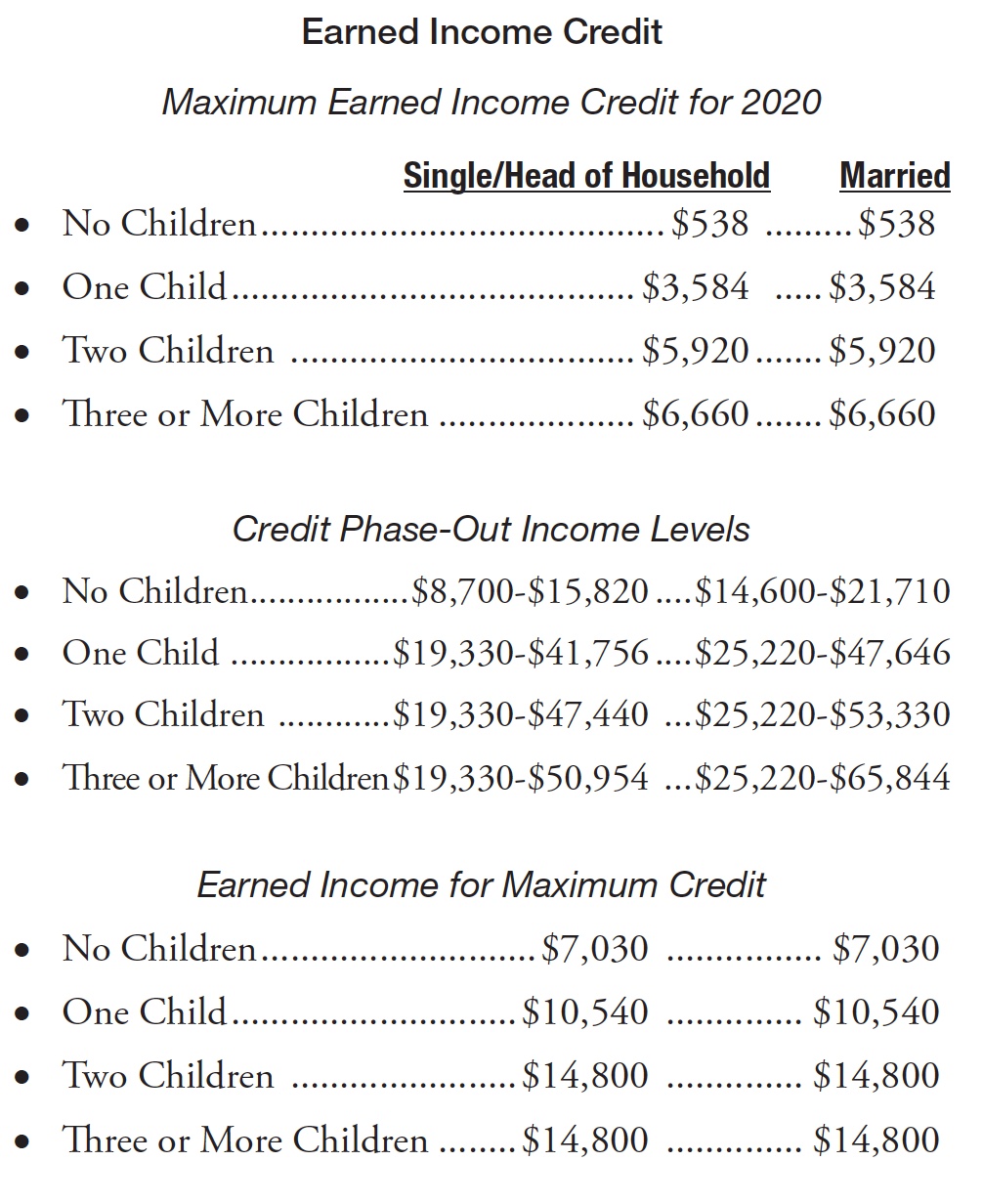

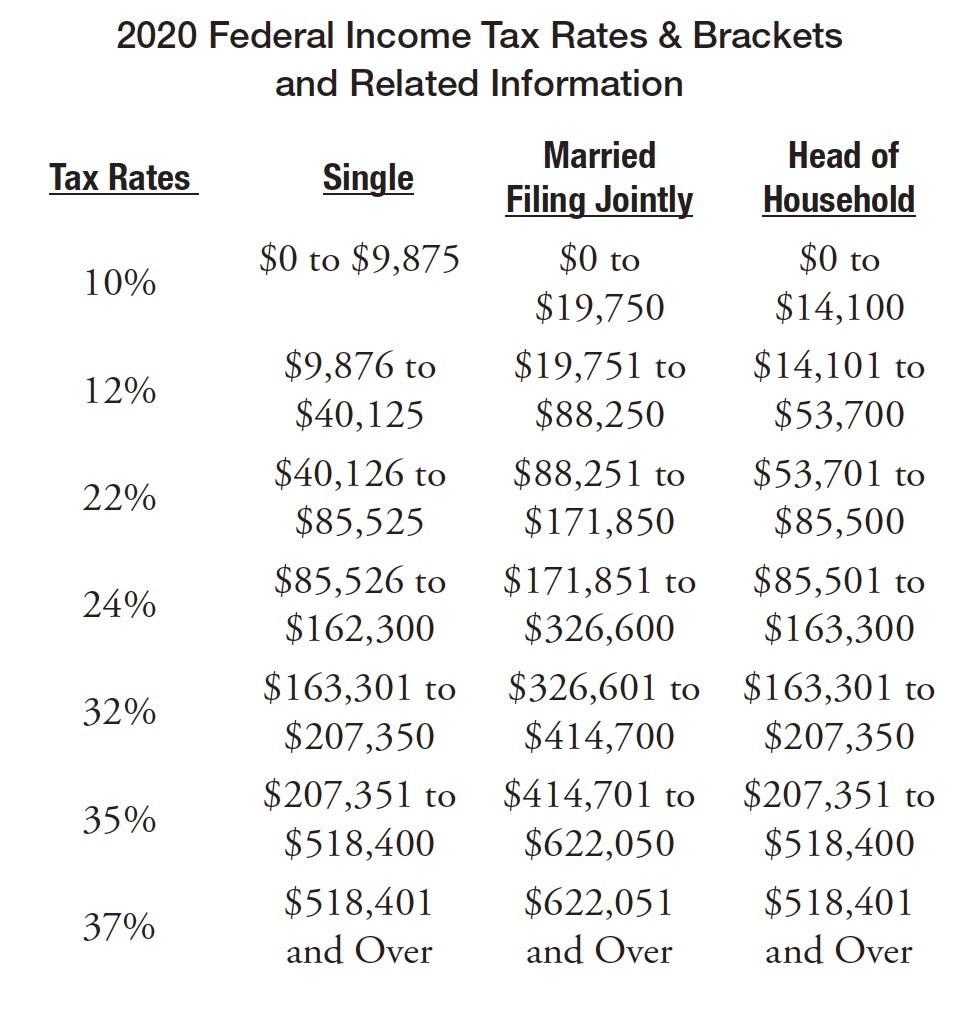

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Millage Taxable Value Calculator Madison Heights Mi

Real Estate Forecast Recession Unlikely In 2020 Real Estate Real Estate Information Real Estate Prices

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

50 Communities With Michigan S Highest Property Tax Rates Mlive Com

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Why Property Taxes Go Up After Buying A Home In Michigan

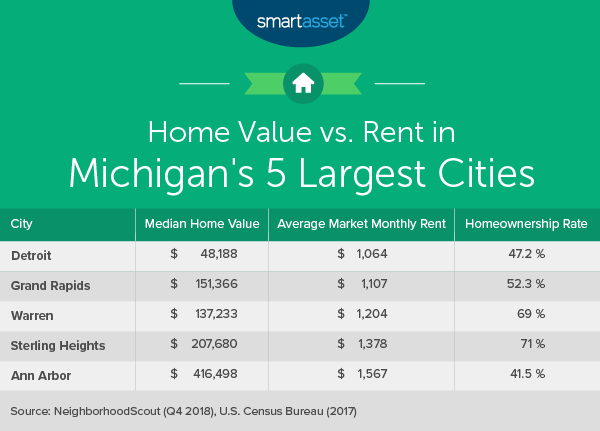

The Best State University Systems Smartasset Higher Education Education States

Michigan Family Law Support Feb 2020 2020 Federal Income Tax Rates Brackets Etc And 2020 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Michigan Property Tax H R Block

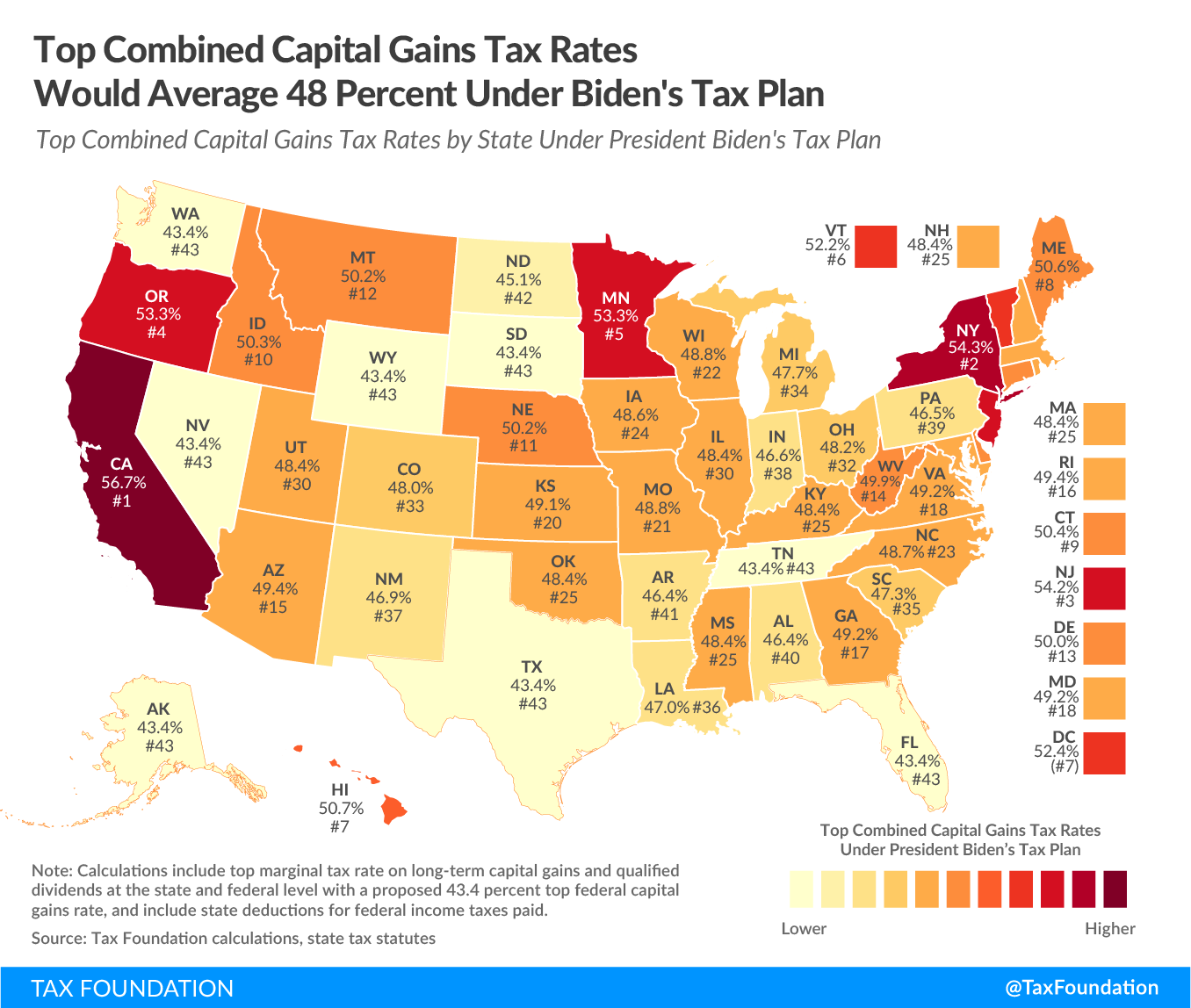

Combined Capital Gains Tax Rate In Michigan To Hit 47 7 Under Biden Plan Michigan Farm News

What Do Your Property Taxes Pay For